Thrown for a loop.

Early last week, Federal Reserve Chair Jerome Powell told Congress the Fed is committed to bringing inflation down to 2 percent. If economic data continues to come in hot, he said, then it’s likely the Fed will raise rates higher than expected and keep them higher for longer.

Economist Lawrence Summers estimates there is 50 percent chance that the Federal funds rate will be 6 percent or higher before the Fed will reach its inflation target, reported Chris Anstey of Bloomberg. Currently, the effective Fed funds rate is 4.57 percent.

A similar statement made by another Fed official the previous week caused United States Treasury yields to rise in anticipation of rate increases and had little effect on the stock market. After Powell’s comments last week, the stock market headed lower.

As investors considered the Fed’s higher-for-longer stance, news broke that a publicly traded bank had been put into receivership by the FDIC. The bank was not huge, but it was a major lender for technology start-ups. Here’s what happened:

Technology companies began to withdraw money from their accounts at the bank to fund operations. This was necessary because rapidly rising rates have made borrowing more expensive and venture capital is more difficult to attract. In turn, the bank liquidated some of its Treasury portfolio at a loss to cover the withdrawals. When the sale and loss was announced, there was a run on the bank as some large venture capitalists and start-up technology firms withdrew their money, reported Low De Wei and Priscila Azevedo Rocha of Bloomberg.

The bank’s closure had a ripple effect, and the value of many bank stocks fell sharply in the United States and overseas. “At first glance, this does not look like a systemic issue. Markets are very sensitive to bad news from the banking sector and worries about it are never good. That being said, one must be very vigilant about any kind of domino effect…,” the head of capital markets strategy at a global asset manager told reporters at Bloomberg.

As some speculated that events in the banking industry might cause the Fed to slow the pace of rate hikes, Friday’s employment report was released. The number of jobs created exceeded expectations again. Molly Smith of Bloomberg reported:

“The U.S. labor market continued to surprise with another month of robust job creation in February. But under the surface, the details were a bit more mixed. The good news is that more people joined the workforce, including women and minorities, and wage growth for many workers actually accelerated. On the other hand, job gains were concentrated in just a few industries and the number of hours worked on average declined.”

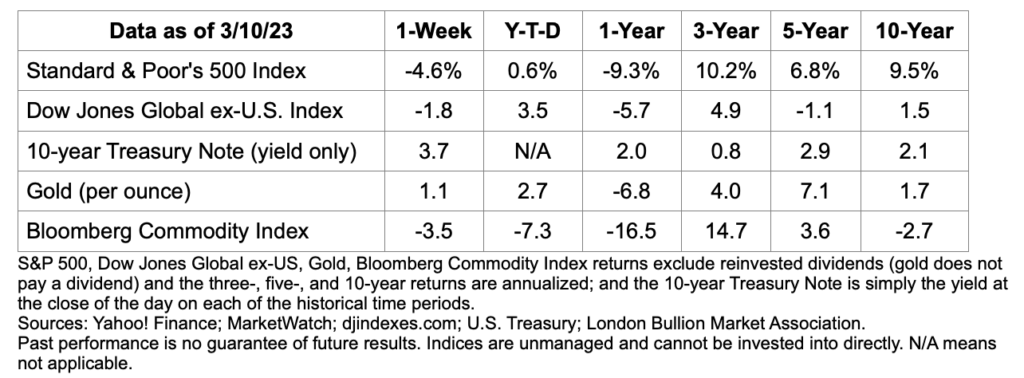

Markets are likely to be volatile this week. Major U.S. stock indices finished last week lower. Treasury yields also moved lower, and the yield curve remained inverted.

Insect Farming

At the intersection of environmental sustainability and food security, scientists are learning more about insects as a sustainable food source. Beetles, caterpillars, ants, bees, wasps, grasshoppers, locusts, crickets and other bugs are already staples in human diets in many parts of the world.

ScienceDirect recently shared a paper on the topic from Journal of Future Foods, which explained the basis for the research:

“Compared to cattle raising, insects emit relatively few greenhouse gases and little ammonia and require significantly less land and water. The nutritional quality of edible insects appears to be equivalent and sometimes superior to that of foods derived from birds and mammals. Insect farming may offer a sustainable means of food production. Since edible insects are calorie dense and highly nutritious, their consumption has the potential to reduce famine worldwide. The presence of high-quality protein and various micronutrients as well as potential environmental and economic benefits render edible insects globally a major potential future food.”

The topic has created a bit of a kerfuffle in Poland, which (along with Norway) has helped fund research into the consumption of insects (entomophagy). One political party has accused the other of planning to force the Polish people to give up meat and eat worms, reported Alan Charlish and Anna Wlodarczak-Semczuk of Reuters.

If you’re ever ready to give bugs a try, recipes for Ginger Cricket Cookies (made with cricket flour), Spicy Critter Fritters, Wax Worm Tacos, gluten-free insect Macaroons, and more buggy treats are available online.

“Your assumptions are your windows on the world. Scrub them off every once in a while or the light won’t come in.”

—Alan Alda, actor

Investment advisory services offered through Keystone Financial Services, an SEC Registered Investment Advisor. These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice. This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer. Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate. Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features. The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index. All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index. The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index. The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market. Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM. The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998. The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones. The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal. The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system. International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets. Yahoo! Finance is the source for any reference to the performance of an index between two specific periods. The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful. Past performance does not guarantee future results. Investing involves risk, including loss of principal. The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete. There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. Asset allocation does not ensure a profit or protect against a loss. Consult your financial professional before making any investment decision. Please contact our office if you would like a list of sources used in creating this content.