What is the most important driver of economic growth in the United States?

The most common way to measure economic output is Gross Domestic Product or GDP. It’s the value of all goods and services produced in our country over a specific period of time. GDP is a combination of the following:

-Government spending

-Business investment

-Consumer spending

-Net exports (Exports minus imports).

In June, U.S. GDP was almost $23 trillion, reported the Bureau of Economic Analysis.

A trillion is a difficult number to comprehend. Jerry Pacheco of KRWG explained the amount like this, “If you laid one billion dollars side by side like tile, they would cover about four square miles. A trillion dollars laid out the same way would cover approximately 3,992 miles, or 1,000 square miles larger than the states of Rhode Island and Delaware combined.”

Twenty-three trillion dollars would cover Rhode Island, Delaware, Connecticut, Hawaii, New Jersey, Massachusetts, New Hampshire, Vermont, Maryland, West Virginia and part of South Carolina.

U.S. GDP grew by 6.5 percent annualized in the second quarter of 2021. Consumer spending was up 7.8 percent, while government and business spending were down, along with net exports. It’s not unusual for net exports to decline because the U.S. imports more than we export. Overall, consumer spending accounted for almost 69 percent of the economy.5 So, the answer to the initial question is that consumer spending is the most important driver of economic growth in the United States.

Consumers tend to spend when they feel confident. Last week, we learned that consumers are feeling a lot less confident than they were in July. Richard Curtin of the University of Michigan Consumer Sentiment Survey reported:

“Consumers reported a stunning loss of confidence in the first half of August. The Consumer Sentiment Index fell by 13.5% from July…The losses in early August were widespread across income, age and education subgroups and observed across all regions. Moreover, the loses covered all aspects of the economy, from personal finances to prospects for the economy, including inflation and unemployment. There is little doubt that the pandemic’s resurgence due to the Delta variant has been met with a mixture of reason and emotion.”

The seven-day moving average of new U.S. COVID-19 cases has been rising since early July, reported Our World in Data.

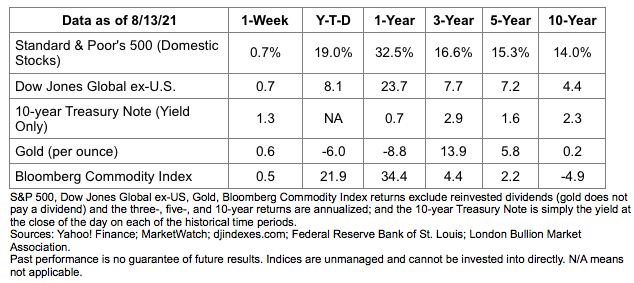

The Standard & Poor’s 500 Index and the Dow Jones Industrial Average finished the week higher. The Nasdaq Composite moved slightly lower, reported Ben Levisohn of Barron’s. The yield on 10-year U.S. Treasuries dipped, too.

All Eyes on Digital Currency

It seems as though everyone is talking about digital currencies these days. Among the topics being discussed are:

Should the Federal Reserve issue a central bank digital currency (CBDC)?

Should digital currencies be better regulated?

In July, Federal Reserve Chair Jerome Powell confirmed that he is undecided about whether the Federal Reserve should issue a CBDC, reported Ann Saphir and Dan Burns of Reuters. He indicated that digital currencies have failed to become a widely accepted means of payment, although a CBDC would eliminate the need for private digital money, especially digital currencies that claim to be pegged to the U.S. dollar. Chris Matthews of MarketWatch explained:

“Critics of stablecoins say they pose significant risks to financial stability, especially after it was revealed that some of these dollar-pegged tokens are not backed by actual U.S. dollars, but a combination of riskier assets…[Chair] Powell said in a congressional hearing that regulators need to apply rules to stablecoins that are similar to those that govern bank deposits and money market mutual funds.”

Congress and the Securities and Exchange Commission (SEC) are both considering ways to regulate digital currency. The pending bipartisan infrastructure bill includes tax-reporting requirements for cryptocurrency brokers. If the bill passes without changes, digital currency sales would be reported to the IRS in much the same way that stock sales are. The change is expected to generate about $28 billion in taxes over a decade to help pay for infrastructure, reported Marcy Gordon of AP News.

In addition to tax regulation, digital currencies may become subject to greater securities regulation. In early August, SEC Chair Gary Gensler discussed the need for cryptocurrency regulation at the Aspen Securities Forum. He said:

“As new technologies come along, we need to be sure we’re achieving our core public policy goals. In finance, that’s about protecting investors and consumers, guarding against illicit activity, and ensuring financial stability… at our core, we’re about investor protection. If you want to invest in a digital, scarce, speculative store of value, that’s fine. Good-faith actors have been speculating on the value of gold and silver for thousands of years…I believe we have a crypto market now where many tokens may be unregistered securities, without required disclosures or market oversight. This leaves prices open to manipulation. This leaves investors vulnerable.”

It seems that changes are coming for the cryptocurrency market.

“Humans are allergic to change. They love to say, ‘We’ve always done it this way.’ I try to fight that. That’s why I have a clock on my wall that runs counter-clockwise.” ― Grace Hopper, U.S. Navy Rear Admiral and computer pioneer

Investment advisory services offered through Keystone Financial Services, an SEC Registered Investment Advisor. These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice. This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer. Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate. Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features. The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index. All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index. The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index. The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market. Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM. The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998. The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones. The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal. The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system. International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets. Yahoo! Finance is the source for any reference to the performance of an index between two specific periods. The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful. Past performance does not guarantee future results. Investing involves risk, including loss of principal. The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete. There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. Asset allocation does not ensure a profit or protect against a loss. Consult your financial professional before making any investment decision. Please contact our office if you would like a list of sources used in creating this content.