Keeping Emotions at Bay During Virus Volatility

Fear, uncertainty, volatility, panic—these emotions are nothing new to the world of investing. In fact, they seem to reappear on a fairly consistent basis. The

Fear, uncertainty, volatility, panic—these emotions are nothing new to the world of investing. In fact, they seem to reappear on a fairly consistent basis. The

When stock markets experience sudden downturns, investors can feel anxious and make decisions detrimental to their long-term goals. After all, when you’ve worked hard for

Although there is a significant financial component to leaving a lasting legacy, it encompasses so much more than just money. It’s easy to get stuck

Stocks fell sharply this week as the world responds to the coronavirus (COVID-19). By the close of the U.S. market on Thursday, the S&P 500

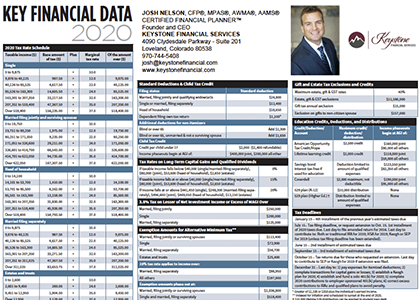

The start of the year is the season for market updates. Financial advisors often host events for their clients during the winter months, providing presentations

On December 20th, 2019, the Setting Every Community Up for Retirement Enhancement (SECURE) Act became law. As the name implies, this law intends to make it easier for

Making a New Year’s resolution is the first step to creating better habits. But making a New Year’s resolution and keeping a New Year’s resolution are not always the

Clients frequently ask whether they should leave their assets in a trust. It depends. Of course, if your net worth exceeds $11 million, putting your

For many of us, benefits are the afterthought of our employment compensation. We get our paycheck, and our eyes go immediately to the dollar amount,