Every once in a while, someone asks me, “Where did you come up with the name, Keystone Financial?” I love this question, because I am very proud of what it really means to me, my staff, and clients. Back in 2010, when I was thinking of what to call my new financial advisory practice, I thought of all kinds of things, including just using my name; like Nelson Wealth Management or Nelson Financial Services. I was encouraged by a few mentors to think of a different name. To think of something that really would represent the values of what my firm was about.

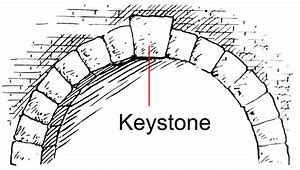

As I was brainstorming, I started thinking that we are a Colorado-based company, and my search led me down the path of things that have to do with Colorado. What I settled on eventually was Keystone Financial Services. Other than just sounding cool, and Keystone being one of Colorado’s most popular ski destinations, I really started thinking “What is a keystone? What does keystone mean?” A keystone is the piece that holds something together, like an arch. The keystone is that middle piece that, if it’s not there, the whole thing ends up not working and would be in danger of falling apart. The more I thought about it, it clicked- that’s what my role is! That’s the kind of company I want to build. The kind of company that would serve as that keystone in my clients’ financial lives.

I stuck with Keystone Financial Services as I launched the company, and later, my team and I started doing some work around Keystone’s values and writing our mission statement. Our mission statement is that we bridge the gap between knowing and doing in the financial lives of our clients. What that really means is that, at the end of the day, there is plenty of information out there. We have information overload in fact! When I became a financial advisor in the late 1990s, people told me that, because of all of the free information on the internet and online trading, financial advisors were going to go extinct. It’s interesting that the opposite has actually happened. Now there is so much information that people don’t know what to do with it. It’s not a lack of knowing the information- people consume information all day long, and almost anything we would want to know is available at our fingertips. The key is knowing the actions that need to be taken and then actually following through and doing it! That’s what I do in all of my client conversations and client meetings. We talk about what they want, where they are now, and together we come up with a plan and take action. If it’s important enough to them, people are going to follow through, and I have the privilege to walk with them every step of the way. And that is what Keystone really is, the piece that bridges the gap between knowing and doing in financial lives of my clients.